With the pandemic still (unfortunately) making headlines, health is at the forefront of everyone’s minds. But your financial health needs to be kept in check as well, especially if the pandemic has put extra pressure on your budget.

In a nutshell, your financial health measures your ability to meet your immediate financial needs, adapt for emergency financial needs, and save for long-term financial needs.

Measuring Financial Health

Being in good financial health means having confidence when it comes to your personal finances. There are three primary factors to evaluate consider:

- Your net worth. Calculate the value of all your assets (savings and things you own that have monetary value) and subtract all your debts and loans. NerdWallet offers a net worth calculator to help.

- Your emergency fund. You want to have enough money saved to cover three to six months of your living expenses if necessary. This is a fund you can tap into for unplanned, major expenses or disruptions, such as job loss or car or home repairs.

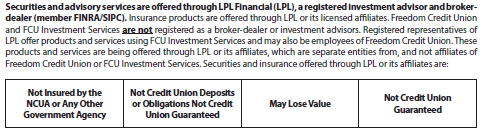

Your retirement savings. It’s never too soon to start saving for retirement. Ideally, you want to save 10 to 15 percent of your income. How much you need to save depends on your expenses and lifestyle. Use this retirement calculator to get a general idea of what you should aim for, and then schedule an appointment with our FCU Investment Services to develop a plan to reach your goals.

Big Picture

There are steps both large and small you can take to improve your financial health, including:

- Paying off debts with the highest interest rates

- Remortgaging your home if rates are at least 1 percent lower than your current rate

- Automating your savings so part of your income goes directly into savings

- Shopping around for the best prices for recurring expenses, such as phone, cable, insurance, etc.

- Automating your bill pay so you don’t miss due dates, which affects your credit score

- Increasing your retirement savings, especially when you get a raise

It’s a good idea to take your financial temperature periodically to ensure you are on track. For example, you want to make sure your income is keeping pace with inflation and expenses, you are reducing your debt, your credit score is good and your investments are sound.

Need help? We are committed to working with our members to improve their financial health. Whether you are opening your first checking account, looking to remortgage, or planning for retirement, our team members are happy to help. We also offer resources, such as our blog and links to other sites, you may find helpful.