Presentations include information about popular cons, how to avoid them and how to report them

According to the FBI’s 2022 Elder Fraud Report, Americans over the age of 60 lost $3.1 billion to fraud last year, an increase of 84 percent from 2021. That’s the highest loss amount reported out of any age group. Freedom Credit Union is taking action to help its members and the community at large, particularly the vulnerable senior population, protect themselves.

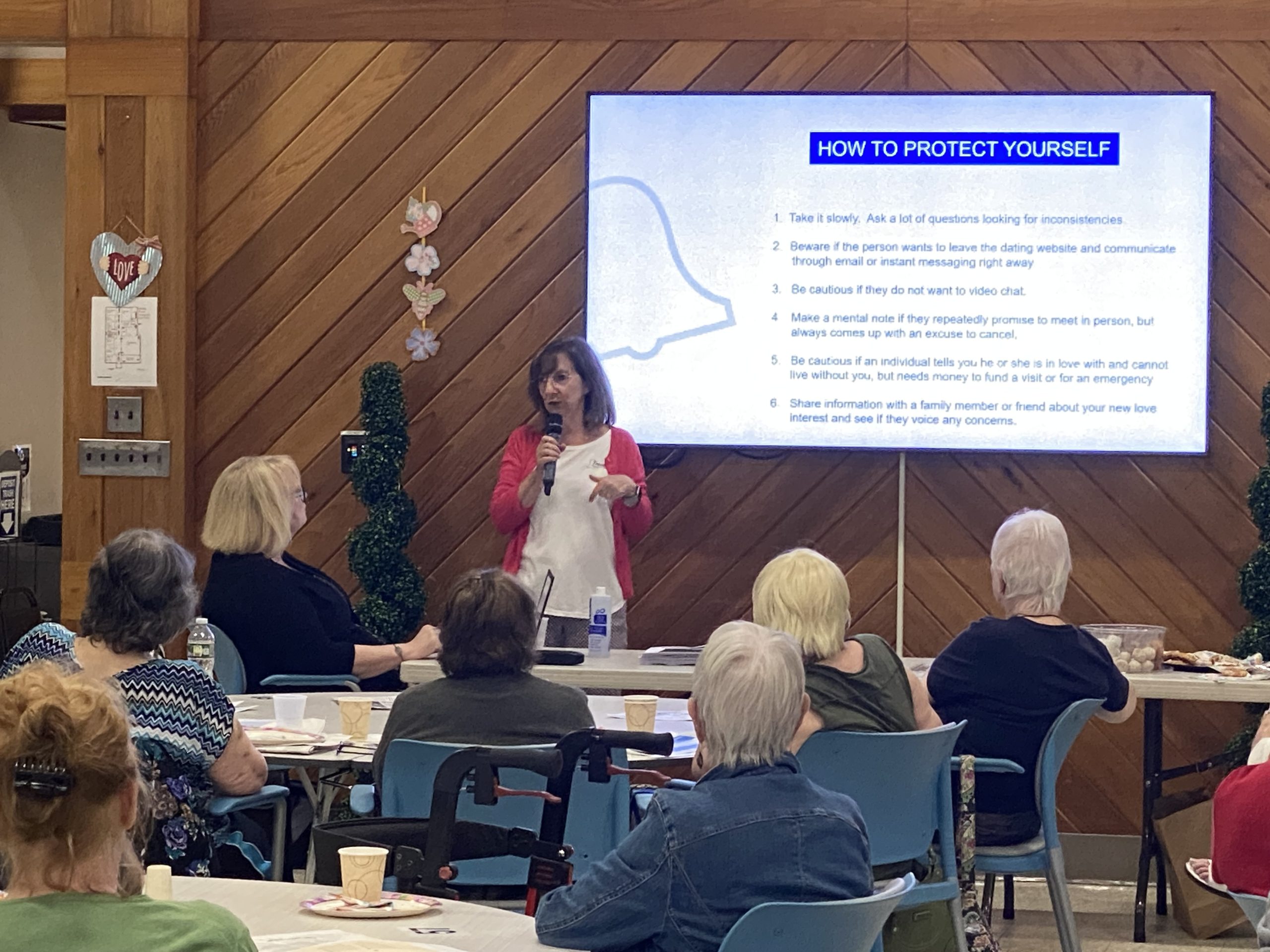

Most recently, this included free educational sessions at senior centers throughout the region, including those in Agawam, East Longmeadow, West Springfield and Chicopee. Freedom’s team also led a fraud education seminar for Health New England employees in Springfield, as well as at the Senior Health and Safety Expo in Greenfield, sponsored by the Franklin County Sheriff’s Office TRIAD Unit. The next session that will be open to the public is scheduled for Wednesday, December 20 at noon at the Pleasant View Senior Center, 328 N. Main Street, East Longmeadow. The seminar is free, and lunch is available for $3. Registration is required by December 19 by calling 413-525-5436.

“We have long been committed to helping our members and community protect their identities and finances from criminals,” said Freedom Credit Union President Glenn Welch. “We regularly communicate with our members about new scams and maintain a robust Cyber Security Center with resources for consumers on our website. We have seen firsthand that seniors are especially at-risk targets, so we developed these free educational seminars to help them shore up their defenses.”

During these sessions, Freedom’s security experts discuss how some of the most common scams work, red flags to look for, strategies to maintain security and resources for those who think they may be victims. Older adults are often prime targets for financial cons as they may have accumulated significant savings and valuable possessions; may not be as technically savvy to online, social and telephone scams; or may be perceived as easier to confuse and intimidate.

“People are often embarrassed if they fall victim to these crimes, but it can happen to anyone,” added Welch. “Scammers have become increasingly sophisticated in their approaches, which can appear quite legitimate. Education is essential to prevention. The sessions we’ve held so far have been well-attended and popular. They offer an open and safe forum for seniors to talk freely and ask questions.”

Senior centers or community organizations wishing to schedule a financial scam prevention session at their facility can call Lisa Pandolfi, fraud analyst at Freedom Credit Union, at 413-505-5717.